Geothermal

Laureyns United is proud to design and install geothermal heating and cooling solutions. By harnessing the energy of the earth we are able to design affordable eco-friendly solutions for your home. Our installers are accredited through the International Ground Source Heat Pump Association (IGSHPA)

What is Geothermal?

Geothermal heating, also referred to as green heat geoexchange, geothermal heat pumps, ground-source heat pumps or water source heat pumps is one of the most efficient ways to heat and cool a home. More and more people are discovering the benefits of geothermal, which use the relatively constant temperature of the Earth. In winter, warmth is drawn from the earth through a series of pipes, called a loop, installed beneath the ground. A water solution circulates through the loop and carries the earth’s natural warmth to a heat pump inside the home. The heat pump concentrates the earth’s thermal energy and transfers it to air circulated through interior ductwork or to radiant heat in flooring. In the summer, the process is reversed; heat is extracted from air inside the home and transferred to the ground – by way of the geothermal loops.

Advantages of Geothermal

-

Extremely efficient

-

Can provide heating, cooling and hot water

-

Long life

-

Low maintenance

-

No outdoor unit

-

Quiet operation

Tax Credits & Incentives

In February 2018, the tax credit was reinstated through 2019 and can be retroactively applied to installations placed in service on January 1, 2017 or later. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit. The credit has no limit and there’s no limitation on the number of times the credit can be claimed.

Inflation Reduction Act “IRA”

Prior to the law, the clean energy credit was supposed be 22% for 2023 with the credit expiring at the end of the year. The “IRA” restores this residential clean energy credit to 30% through 2032. “IRA” has updated the “Energy-efficient Home Improvement Credit”. This used to be capped at $500 lifetime, but is now increased to a $1,200 that can be taken annually.

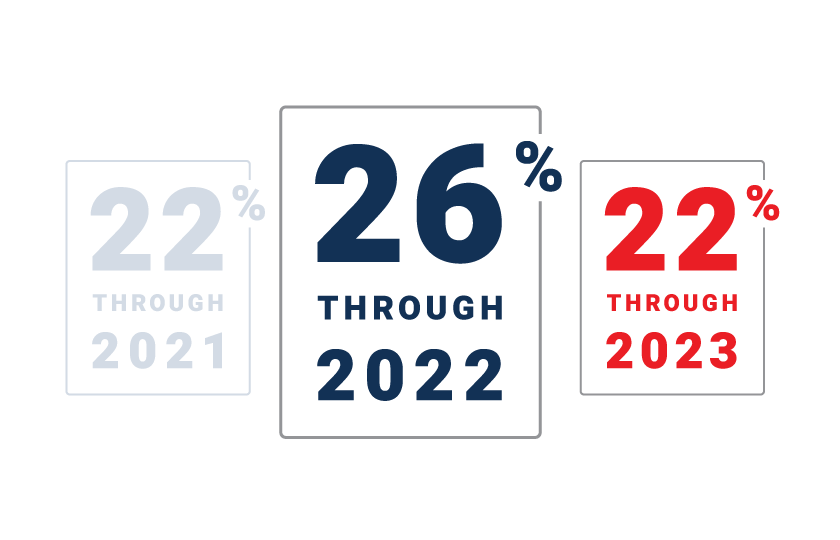

US Tax Credits Through 2023

The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. While the 22% credit expired at the end of 2021, a 26% credit is still available through 2022. The incentive is set to decrease once again down to 22% in 2023, though, so act quickly to save the most on your installation.